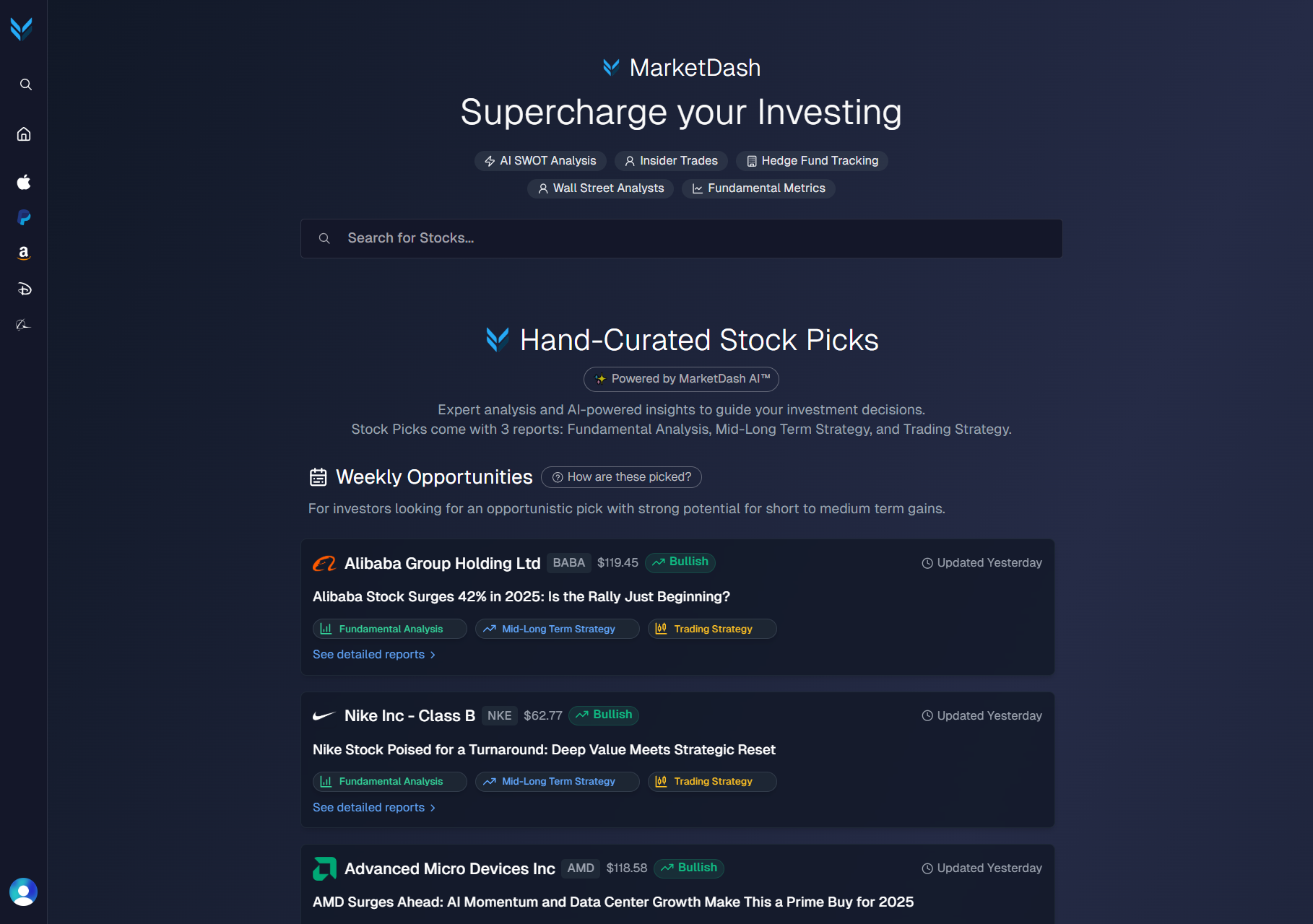

MarketDash Stock Picks

Hand-Curated strategies to make you profitable

Complete Analysis

Each pick comes with detailed reports: Fundamental Analysis, Mid-Long Term Strategy, and Trading Strategy.

Weekly Opportunities

For investors looking for an opportunistic pick with strong potential for short to medium term gains.

Weekly Opportunities

For investors looking for an opportunistic pick with strong potential for short to medium term gains.

Strengths

Financial Resilience and Diversified Revenue

Apple demonstrated strong financial performance in Q2 2025 with revenue of $95.36 billion (5% YoY growth) and EPS of $1.65 (8% YoY increase), beating estimates.

Supply Chain Diversification and Geopolitical Mitigation

Apple accelerated manufacturing shifts to India and Vietnam, with a majority of U.S. iPhones now produced in India.

Brand Leadership and Market Dominance

Apple retains its position as the world's most valuable brand (valued at $574.5 billion), leveraging premium positioning and customer loyalty.

Services Growth and Recurring Revenue

Services revenue reached an all-time high, driven by double-digit growth in subscriptions and ecosystem engagement.

Shareholder Value Through Buybacks and Dividends

Apple returned $29 billion to shareholders in Q2 2025, including a $100 billion stock buyback authorization.

Competitive Differentiation Through Innovation and Ecosystem

Apple's focus on seamless ecosystem integration, cutting-edge design, and continuous R&D maintains its competitive edge.

Strengths

Financial Resilience and Diversified Revenue

Apple demonstrated strong financial performance in Q2 2025 with revenue of $95.36 billion (5% YoY growth) and EPS of $1.65 (8% YoY increase), beating estimates.

Supply Chain Diversification and Geopolitical Mitigation

Apple accelerated manufacturing shifts to India and Vietnam, with a majority of U.S. iPhones now produced in India.

Brand Leadership and Market Dominance

Apple retains its position as the world's most valuable brand (valued at $574.5 billion), leveraging premium positioning and customer loyalty.

Services Growth and Recurring Revenue

Services revenue reached an all-time high, driven by double-digit growth in subscriptions and ecosystem engagement.

Shareholder Value Through Buybacks and Dividends

Apple returned $29 billion to shareholders in Q2 2025, including a $100 billion stock buyback authorization.

Competitive Differentiation Through Innovation and Ecosystem

Apple's focus on seamless ecosystem integration, cutting-edge design, and continuous R&D maintains its competitive edge.

MarketDash SWOT Analysis

Strengths, weaknesses, opportunities, and threats

Identify Competitive Advantages

Discover what makes companies unique and sustainable.Discover what makes companies unique and sustainable. Our AI analyzes brand strength, market position, and operational excellence to reveal true competitive moats.

Spot Hidden Threats

Uncover potential vulnerabilities before they impact your portfolio.Uncover potential vulnerabilities before they impact your portfolio. From regulatory threats to market disruption risks, stay ahead of challenges that could affect stock performance.

Strategic Decision Making

Make better investment decisions with comprehensive strategic context.Make better investment decisions with comprehensive strategic context. Understand how internal capabilities align with external market conditions for each company.

Track The Experts

Track the latest recommendations, price targets, and earnings estimates from top Wall Street analysts and investment firms.

Intrinsic Value

Our proprietary Discounted Cash Flow model calculates the true intrinsic value of stocks based on future cash flow projections and fundamental analysis.

Intrinsic Value Breakdown

Fundamentals

Get comprehensive fundamental analysis with detailed financial metrics, ratios, and insights to make informed investment decisions.

Growth Metrics

Track revenue growth, earnings growth, and other key performance indicators over multiple time periods.

Valuation Ratios

Analyze P/E, P/B, P/S ratios and other valuation metrics compared to industry averages and historical data.

Profitability Analysis

Examine margins, ROE, ROA, and other profitability metrics to assess company efficiency and performance.

Financial Health

Monitor debt levels, liquidity ratios, and financial stability indicators to gauge company strength.

Balance Sheet Deep Dive

Comprehensive breakdown of assets, liabilities, and equity with trend analysis and peer comparisons.

Cash Flow Analysis

Operating, investing, and financing cash flows with detailed breakdowns and quality assessments.

Our users are happy and profitable.

Trusted by thousands of profitable investors

Mike T.

I've been dabbling in stocks for a while, but MarketDash made it so much easier to actually understand what I'm looking at.

James L.

As a retiree, I thought stock research tools were all way too complicated for me. MarketDash proved me wrong. It's simple, and it helps me focus on what actually matters.

Sarah P.

I've been investing for years, but MarketDash has saved me so much time. The insights are super clear, and it's way less complicated than other tools I've tried. Highly recommend it to anyone serious about stock research.

Rebecca S.

MarketDash made me feel like I actually know what I'm doing. I don't have hours to dig through data, so having everything laid out clearly is a huge help.

Tom C.

I've tried a bunch of different research platforms, and most of them are either too basic or too complicated. MarketDash is the perfect balance—it gives you everything you need without the clutter.

Linda N.

Stock research used to stress me out, but MarketDash makes it way more manageable. I love how it explains things so clearly without feeling dumbed down. I wish I'd found this sooner!

Affordable Pricing, Unbeatable Value

Premium

For serious investors

$29.17

per month, billed annually

- Everything in Free

- 5 years of financial data

- Key Financial and Profitability Metrics

- Historical Fundamental Charts

- Accurate data updated Daily

- Hand-curated stock picks

- Mid-Long Term & Trading Strategies

- AI SWOT Analysis

- Insider Trades

- Hedge Fund Trades

- Wall Street Analyst Estimates

- Intrinsic Value Analysis

- Historical Fundamental Charts