9 Best Investor Preferences Tools for Beginners and Pros

MarketDash Editorial Team

Author

Market fluctuations force investors to decide whether to hold, trim, or rebalance positions when conditions shift unexpectedly. Understanding how to predict stocks means integrating objective signals with tools that capture investor profiles, risk tolerance, and goal-based criteria. Advanced solutions such as robo advisors, automated rebalancing, and portfolio optimization help tailor decisions to individual risk profiles and reduce manual effort.

A thoughtful approach to portfolio management blends quantitative measures with personalized settings to offer clearer insights and refined strategies. Effective integration of screening, analytics, and automated decision tools can streamline the path to optimized returns. MarketDash's market analysis provides a consolidated dashboard that delivers actionable insights and simplifies the investment decision process.

Summary

- Investor preference tools matter because they translate stated profiles and observed behavior into ranked actions. With 60% of investors now using digital platforms for portfolio management, reliable preference engines are a baseline expectation.

- Half of professional allocators already rely on advanced analytics for decisions, with 50% of professional investors using analytics tools, which explains why seasoned teams pair deep research with pattern detection rather than relying on alerts alone.

- Latency and data freshness are critical, as 75% of investors prefer real-time analytics; slow batch updates introduce timing risk and can cost them actionable opportunities.

- AI-driven recommendation engines require explainability and guardrails, as about 60% of investors use AI platforms and models that, when overfitting recent behavior, can reinforce bad habits without counterfactual testing and human oversight.

- Integration and data hygiene drive adoption, not UI alone: mapping identifiers upfront eliminated roughly 80% of reconciliation mismatches in pilots, and organizations report saving about 20 hours per week after automating data quality.

- Run tool selection as an experiment, using a 7- to 14-day sandbox for core functionality and a 90-day shadow test for outcome validation, while tracking override reasons and time-to-decision to measure real adoption.

- MarketDash's market analysis addresses this by combining screening, analytics, recommendation engines, allocation templates, tax-loss harvesting options, and a single-investor dashboard, enabling teams to act on ranked signals while preserving auditable decision trails.

9 Best Investor Preferences Tools for Beginners and Pros

These nine tools work together to support all parts of the investor process, from generating ideas and sourcing deals to managing relationships and getting things done. Each tool meets a particular investor need, whether it’s speed, signs of trust, relationship information, or legal certainty.

Below, I will explain what each tool does in practice, who should use it, and the trade-offs involved in using them in a careful investing approach. Additionally, practical market analysis can enhance your decision-making.

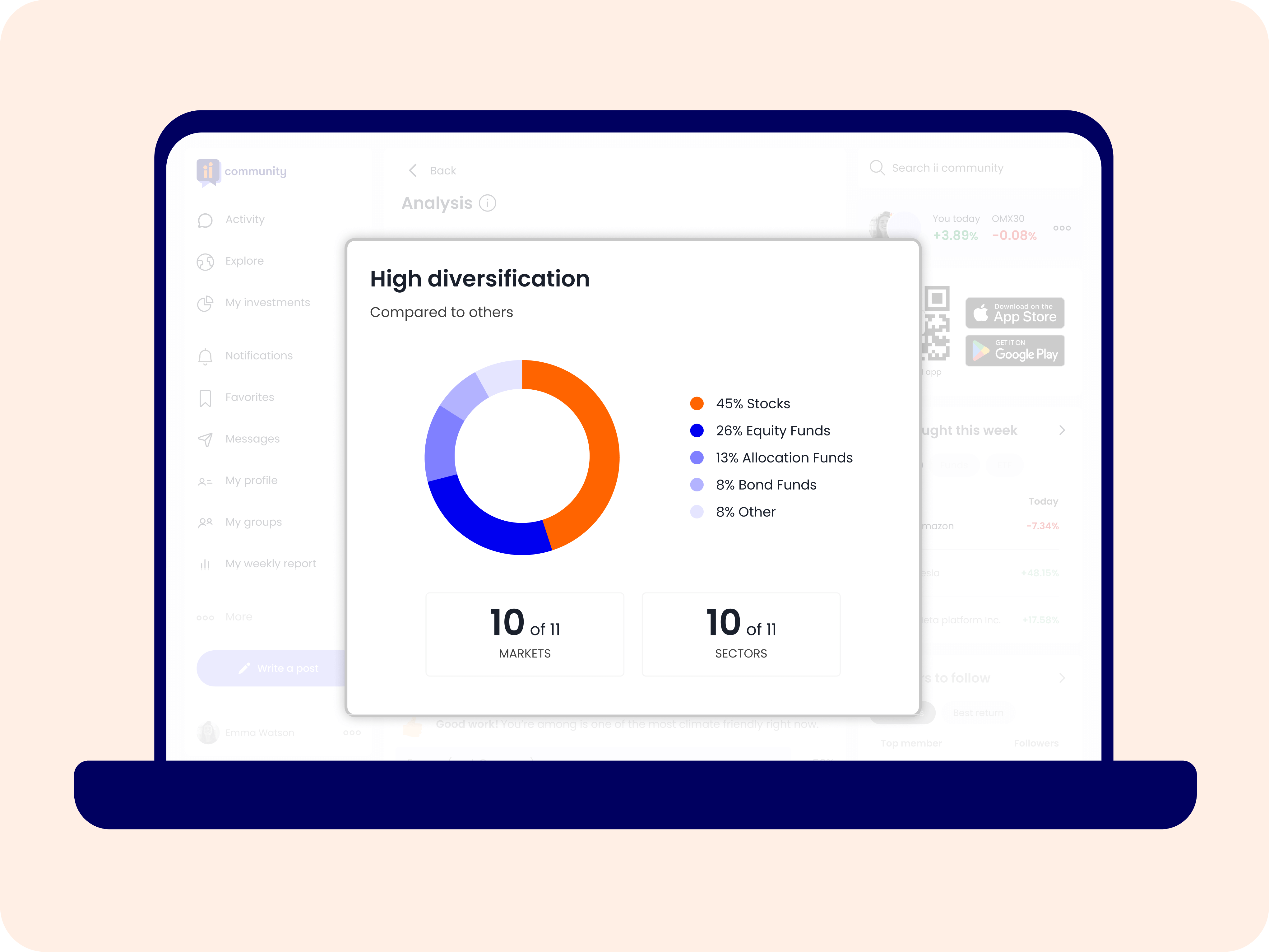

1. MarketDash

MarketDash is a simple stock research platform that combines AI-driven insights with carefully selected stock picks. This helps investors get clear, actionable information on market opportunities. It provides timely recommendations that combine short-term, event-driven plays with long-term fundamental strength, and includes detailed reports on financial health, growth strategies, and trading tactics. Designed for both beginners and experts, the tool simplifies complex analysis with visual aids and expert selection, helping users quickly identify undervalued assets and competitive advantages.

Key Features

- Hand-curated stock picks with short- to medium-term gain potential.

- Comprehensive reports that include fundamental analysis, mid- to long-term strategy, and trading recommendations.

- AI-powered insights on brand strength, market moats, and risks of vulnerability.

- Visualized balance sheets, historical graphs, and key financial metrics.

- Wall Street analyst estimates, price targets, and unique DCF valuation models.

Best For

- Busy investors looking for quick, reliable stock ideas without deep research.

- Beginners who need simplified financial breakdowns and visuals.

- Swing traders aim for short-term gains based on events.

- Long-term investors evaluate sustainable business advantages.

- Part-time retail investors who want clear information with professional-grade data.

Use Cases

- Screening for stocks that reacted to recent earnings beats, like Apple's Q2 2025 results.

- Assessing changes in manufacturing or growth in services for supply chain opportunities.

- Comparing brand values and competitive advantages among tech companies.

- Modeling intrinsic value using DCF for buy-and-hold decisions.

- Tracking analyst consensus before major market events.

Pros

- The user-friendly interface is appreciated by both retirees and professionals for its simplicity.

- Saves significant research time with pre-analyzed, carefully selected picks.

- Balances short-term opportunities with a focus on long-term fundamentals.

- Affordable pricing at $29.17/month for premium access.

- Trusted by thousands, receiving consistent positive feedback on clarity.

2. PitchBook

PitchBook is a valuable research tool that leverages extensive historical data on deals, funds, and investor activity. This helps users find venture capitalists who fit certain funding stages and areas. Founders and investors can create lists, such as those highlighting recent activities in specific areas, such as digital health. They receive ranked suggestions, along with the likelihood that each investor will respond, based on historical data.

Key Features

- Advanced AI-driven deal matching based on sector, stage, and timing.

- Probability scores for investor responses derived from historical behaviors.

- Comprehensive database covering millions of deals and fund movements.

- Custom query builder for tailored investor searches.

- Integration with CRM systems for seamless lead tracking.

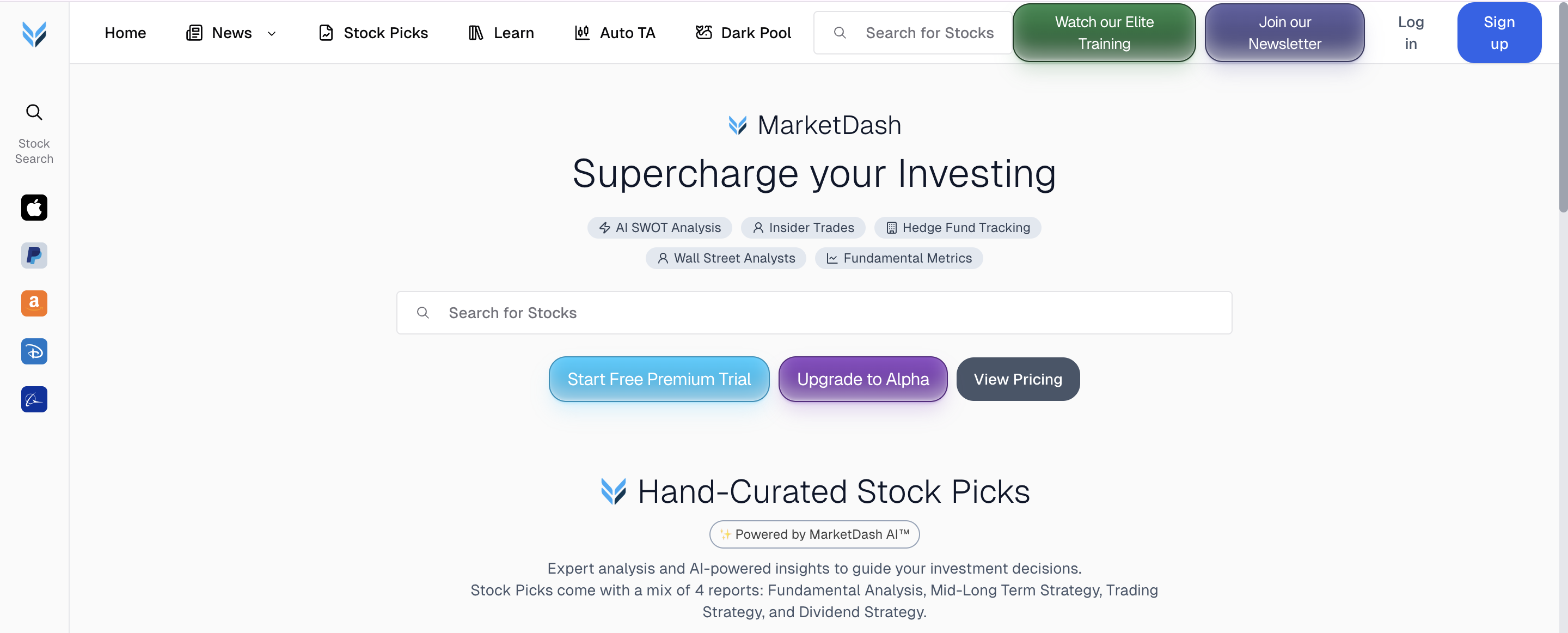

3. Crunchbase Scout AI

Crunchbase Scout AI works like an intelligent alert system. It looks for new fund launches, board appointments, and investment partnerships in its extensive database.

It sends notifications to investors who are likely to make their next investment. This helps users time their pitches precisely, enabling them to secure new funding before opportunities pass.

Key Features

- Real-time alerts for new funds and investment groups.

- Analysis of board changes to predict new priorities.

- "Likely to invest next" rankings based on recent trends.

- Integration with Crunchbase's extensive investor network.

- Customizable notifications for specific sectors or stages.

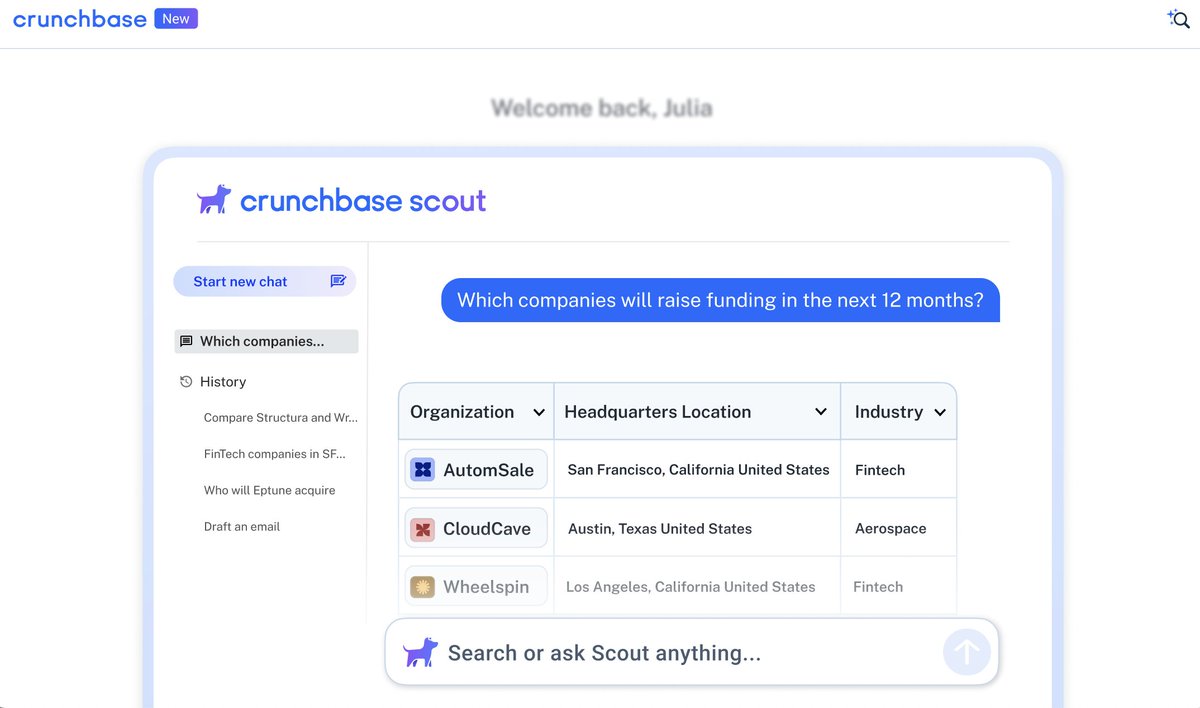

4. Affinity

Affinity is a relationship intelligence platform that processes large volumes of email, calendar, and CRM data. It calculates dynamic engagement scores for each investor contact, identifying warming relationships and fading connections. This helps users focus on the most promising leads. By switching from manual prioritization to automated insights, Affinity ensures that high-potential interactions get immediate attention.

Key Features

- Dynamic engagement scoring from interaction history.

- Analysis of emails, meetings, and CRM activities.

- Alerts for warming or cooling investor relationships.

- Relationship mapping across networks.

- CRM integration for automated lead prioritization.

5. Signalfire HELIOS

Signalfire HELIOS is an innovative tool that analyzes trends in hiring, product development, and web traffic to predict evolving investor interests. It is shared with portfolio companies so founders can adjust their pitches to align with emerging VC theses as they begin to take shape.

This forward-looking resource shifts the strategy from relying on past data to focusing on expected changes, giving a competitive edge in fast-changing markets.

Key features

- Predictive analysis of hiring and product launch signals.

- Traffic spike monitoring for interest indicators.

- Thesis evolution forecasts for VC firms.

- Portfolio access to a proprietary data engine.

- Custom dashboards for opportunity timing.

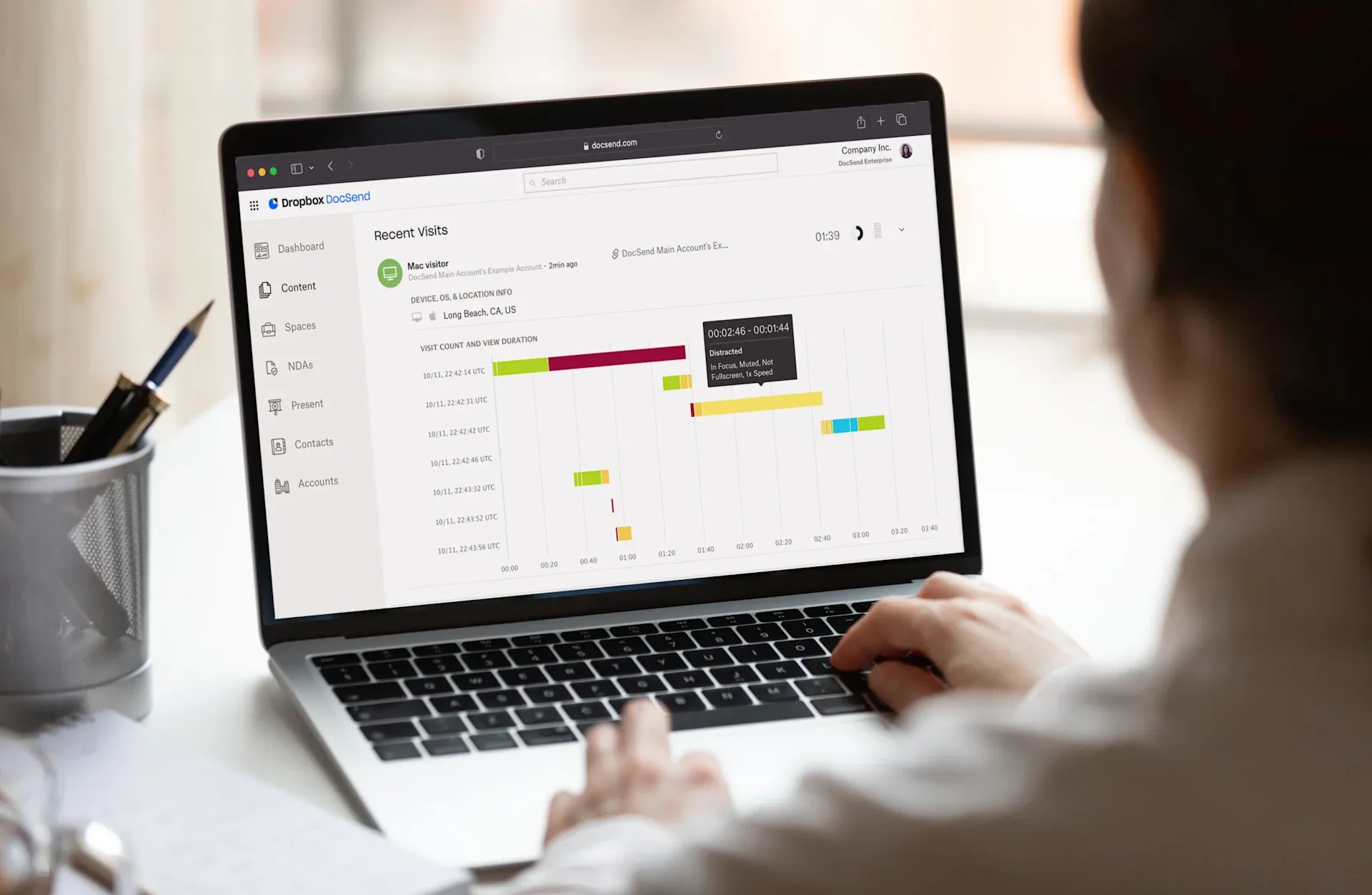

6. DocSend Advanced Analytics

DocSend Advanced Analytics uses machine learning to track how viewers interact with pitch documents. It examines details such as how much time they spend on each slide and compares this to successful fundraisers.

It identifies patterns of engagement that match past term sheet issuers, helping follow up at the right time. This detailed insight transforms document views into practical sales intelligence, improving conversion timing.

Key Features

- Slide-by-slide viewing time tracking.

- Benchmarking against historical fundraising data.

- Alerts for high-engagement patterns.

- Machine learning for behavior comparison.

- Integration with email and CRM for follow-up automation.

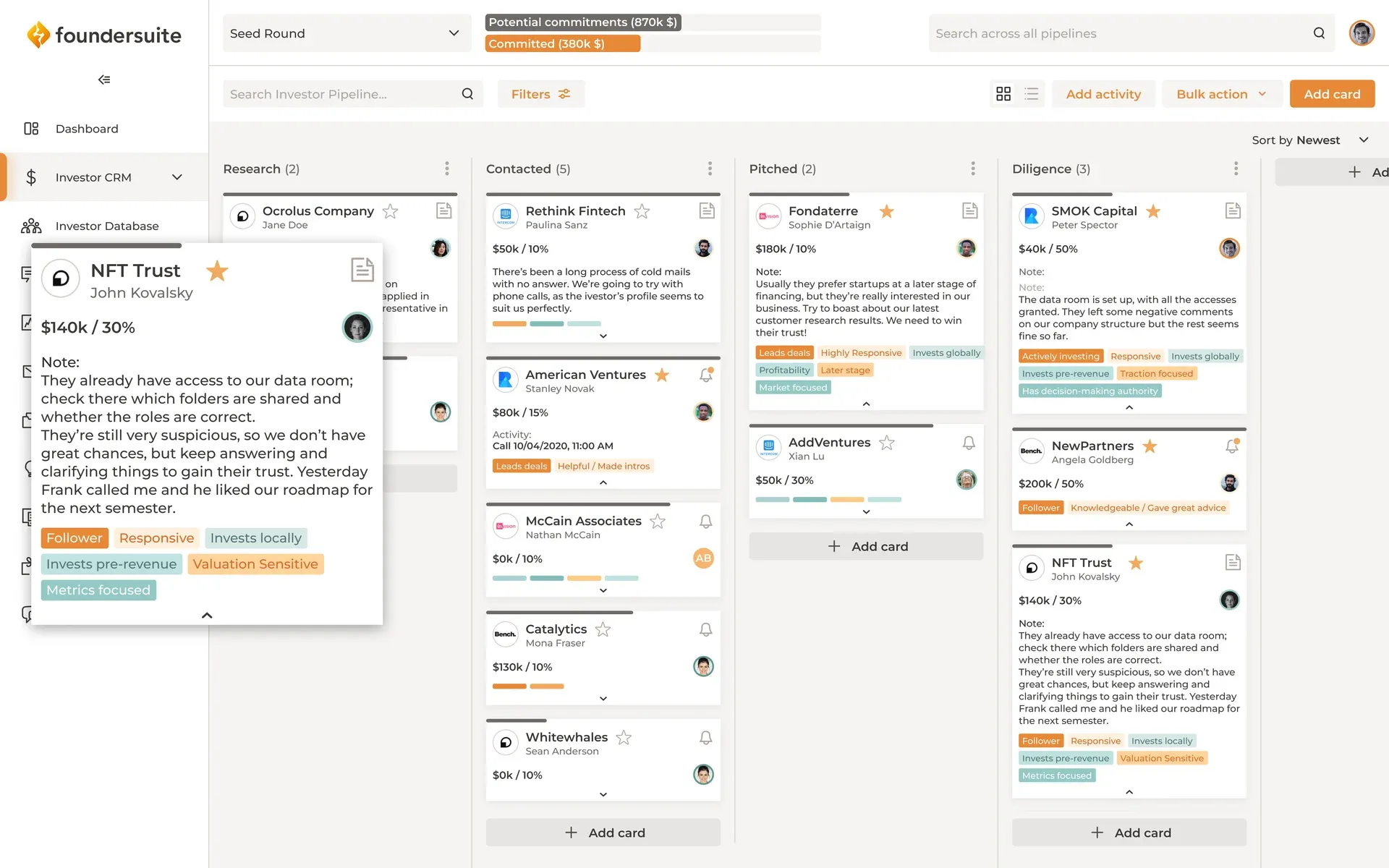

7. Foundersuite

Foundersuite provides a complete cloud platform designed for fundraising. It includes an investor CRM, a database with over 216,000 profiles, secure data rooms, pitch deck hosting, and bulk email features. It makes the whole process easier, from finding leads to closing deals, by bringing all the tools together for effective campaign management. Users benefit from organized workflows that grow with their outreach efforts.

Key Features

- Investor CRM for managing relationships.

- Database of 216,000+ investor profiles.

- Secure data room for sharing documents.

- Pitch deck hosting and analytics.

- Bulk email tools for targeted campaigns.

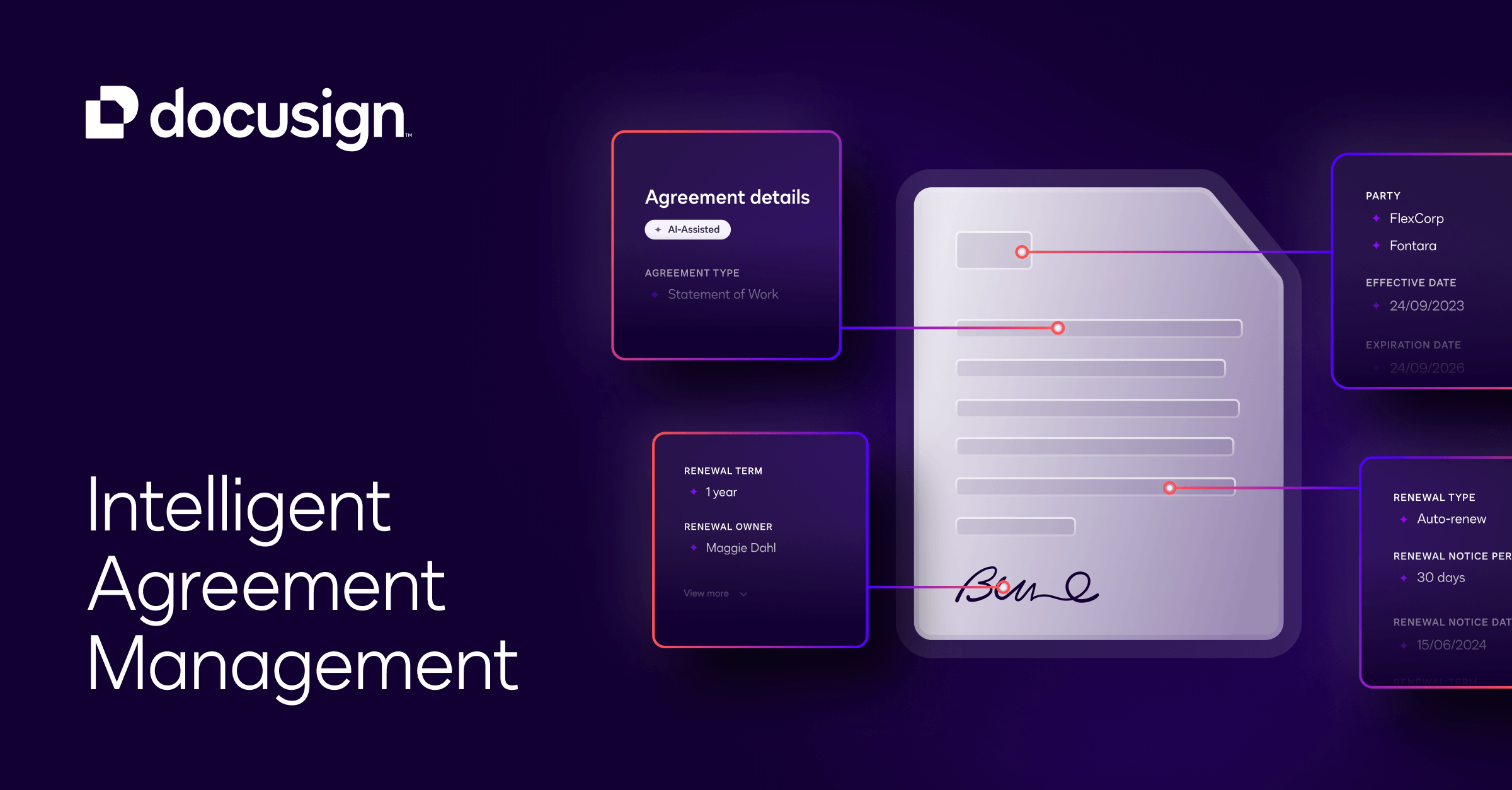

8. DocuSign

DocuSign offers a robust electronic signature solution that ensures investment document approvals are secure and legally binding. It includes detailed audit trails and seamless cloud integrations. This accelerates deal completion by eliminating paper-related delays, enabling people to review, sign, and store agreements efficiently while still complying with industry rules.

Key Features

- Secure electronic signatures that are legally enforceable.

- Complete audit trails for every document action.

- Works with cloud storage and CRM platforms.

- Meets global e-signature standards.

- Mobile access for approvals on the go.

9. AngelList

.webp)

AngelList is a lively networking hub that connects startups with over 100,000 angel investors and venture capitalists. It offers customizable profiles, capital-raising features, and talent-finding tools. This platform provides founders with market insights and syndication opportunities, enabling them to present their businesses directly to qualified backers. This helps build direct relationships that avoid traditional gatekeepers, making it easier to access funding networks.

Key Features

- Startup profile creation for investor visibility.

- Access to 100,000+ angel and VC contacts.

- Capital-raising tools with syndication support.

- Talent matching for team building.

- Market insights and trend analytics.

What should you expect when adopting these tools?

When adopting these tools, expect a transition period where you trade busywork for pattern-building. Initially, your win rate may fluctuate as you adjust your filters. However, by tracking results carefully and keeping a disciplined journal, you will be able to tell apart true edge from noise within a quarter.

It can feel uncomfortable at the start because you need to trust signals over your instincts. That discipline is precisely what separates hobby trading from repeatable investing.

This solution sounds neat, but the things that usually confuse teams are surprisingly human and structural, not just technical.

Related Reading

- What is Top-Down Analysis

- Fundamental vs Technical Analysis

- Portfolio Risk Assessment

- Fundamental Stock Analysis

- Equity Analysis

- How to Identify Undervalued Stocks

- Financial Statement Review

What Are Investor Preference Tools, and How Do They Work?

Investor preference tools work by turning stated values and real trading behavior into a flexible decision engine that ranks choices you can take action on, rather than just listing them. They combine behavioral signals, market data, and policy limits to ensure recommendations are prioritized, manageable to verify, and continuously updated as your goals or market conditions change. For practical insights into your trading, consider our market analysis.

How do these systems learn what you actually want?

When preference models operate, they distinguish between two kinds of signals: stated and revealed. Stated signals are the profile answers you give once; revealed signals are the small, repetitive actions you do, like how often you sell winning trades, use margin, or ignore suggested sells. A key step many teams miss is giving sufficient weight to revealed behavior, as emotional bias often shows up there.

After three months working with financial advisors, it became clear that clients who viewed themselves as long-term traders still made short-term trades when volatility increased. As a result, the system had to adjust its suggestions to focus on reducing behavioral friction, rather than relying solely on what they said they intended to do.

What signals actually move the needle?

Beyond age and risk tolerance, proper signals include liquidity constraints, tax-sensitivity windows, option usage, concentration limits, and event-horizon triggers tied to life events. Sophisticated tools also analyze small behaviors, such as repeated watchlist views, canceled order attempts, or size changes after news. These behaviors are turned into probability scores that change recommendation ranks. This is why practitioners are building preference models that tag each recommendation with the main driver, whether it is a tax-loss harvesting opportunity, a momentum signal, or a need for rebalancing.

Why do people trust digital preference tools now?

Because usage is already mainstream, it changes expectations. Fidelity's 2025 Investor Insights Study reports that 60% of investors use digital platforms to manage their portfolios. This means these models must operate reliably across mobile and desktop devices and handle millions of small decisions without failure. This demand raises another point: Fidelity's 2025 Investor Insights Study also finds that 75% of investors want tools that provide personalized investment recommendations. Accuracy and customization aren't just optional features; they are basic expectations.

How do systems prevent reinforcing bad habits?

A problem-first approach means that a model learning only from recent trades will likely reinforce mistakes. This failure mode is transparent: panic selling can become the new normal, and the tool may unintentionally reward such behavior.

The technical solution involves counterfactual testing, penalty terms for actions that change too quickly, and human checks—practically, having a recommendation system that shows both the machine score and the human reasoning behind it.

Also, a calibration checkpoint happens every quarter. This allows human review of any significant weight changes to prevent overfitting to a short-term two-week drop.

How do static profiles impact recommendations?

Most teams manage preferences using a static onboarding form, which is familiar and straightforward. This method might work at first, but hidden costs emerge when circumstances change. Static profiles can drift, reducing the accuracy of recommendations.

This misalignment causes poor adherence and avoidable tax or execution costs. Teams find that platforms like MarketDash effectively mix automated recalibration with expert curation. This combination accelerates the signal-to-action cycle while preserving human judgment, ultimately reducing the time required to adjust strategies in response to new market conditions.

What governance and privacy knobs matter?

Constraint-based thinking helps ensure good governance. If tax sensitivity is high, lock recommendations that lead to short-term gains unless they are clearly unlocked. When looking at ESG, if it is a stated preference, score based on verified ESG metrics. It's essential to maintain an explainability layer so users can untimestamped decision trails, and consented data scopes are must-haves; both regulators and users want reproducibility and the ability to understand why a stock received a low score.

Also, audit logs, decision trails with timestamps, and consented data scopes are must-haves; both regulators and users want reproducibility and the ability to go back on automated changes.

Lastly, create role-based preference policies; this allows advisors to override client-level defaults during scheduled reviews without compromising auditability.

How should preference tools behave?

Think of a preference tool as a thermostat that learns from where people put their hands on the wall. It cannot chase the hottest spot; otherwise, the whole house will get too hot. A better system learns patterns over time, sets rules, and asks for confirmation when a recommendation suggests actions that go against long-term goals.

What is the gap between stated and revealed preferences?

The difference between what people say they want and what they actually do is a subtle challenge that most tools miss. This gap will be explained in the next section.

Types of Investor Preferences Tools

Investor preference tools group into clear functional types. Each type addresses a different problem in decision-making: rule enforcers that tie strategy to goals, behavioral layers that encourage better choices, analytics hubs that keep signals up to date, and governance layers that make every recommendation easy to verify.

These are separate pieces you can mix, not a single solution that does everything well.

What are policy and constraint engines?

Policy and Constraint Engines are essential for getting consistent outcomes even when conditions change. A policy engine turns goals into enforceable rules, such as limits on concentration, locked windows around planned withdrawals, or tax-aware sell thresholds. These engines are mysterious black boxes.

The real failure mode occurs when there is silent drift, where a client’s profile remains unchanged while their cash needs change. It is crucial to create rules with clear triggers and expiration dates to ensure recommendations do not become outdated as life or market conditions change.

How do behavioral friction and nudge layers work?

Behavioral friction and nudge layers are essential for managing emotional responses during critical moments. They add small challenges or rewards before making big decisions.

Examples include timed confirmations for large trades, staged order sizes to help reduce panic selling, and ongoing reminders connected to long-term goals. These tools not only reduce errors but also preserve cognitive bandwidth, assisting people to focus on judgment rather than reacting impulsively.

Why are preference adjustments often manual?

Most teams manage preference adjustments with manual notes and temporary spreadsheets because this approach is easy to understand and initially less costly. However, as rules increase and exceptions arise, auditability disappears, making small changes create problems over time.

Teams find that platforms made for preference governance can centralize constraints, record decisions with timestamps, and show conflicts before they escalate. This reduction in reconciliation work shifts a process that usually takes days into one that can be completed in hours, while still maintaining a clear record for review.

What role do AI recommendation and scoring engines play?

AI recommendation and scoring engines are critical for ranking and personalization. However, they should be made for explanation and adjustment, not just for accuracy. According to Bigdata.com, 60% of investors use AI-driven platforms to manage their portfolios, underscoring the importance of making these models understandable. Companies that overlook this need may lose users, even if their predictions seem right.

In practice, AI is an advisor that gains trust by explaining why it suggests one action over another. It should also give users tools to adjust their responses to short-term changes.

Why is real-time analytics important?

Real-time analytics and signal hubs are critical because latency matters; opportunities and threats arise quickly, and batched updates can create timing risks. According to Bigdata.com, 75% of investors prefer tools that offer real-time data analytics. Real-time capability is now a key product decision rather than just a nice-to-have feature.

Design your stack to ensure the analytics hub streams survivorship-filtered feeds, recalculates ranks continuously, and displays only the highest-priority alerts. This approach helps keep interruption costs low while maintaining speed.

What are the explainability, audit, and collaboration layers?

When decisions have consequences, you need records that show why a recommendation was made and who approved any override. Audit layers keep timestamped reasons, human notes, and counterfactuals. This helps with post-mortems and justifications for clients or regulators.

Setting up collaborative workflows lets advisors flag recommendations, ask for second opinions, and lock changes until they are reviewed. These features transform preference systems from standalone tools into reliable team tools.

How do scenario simulators and what-if engines function?

Scenario simulators and what-if engines let users see how changes in preferences will affect different time periods and accounts before implementing them. They can highlight critical points, such as how a new liquidity limit may require earlier rebalancing, or how a tax-aware rule could affect realized gains during the tax year.

A quick simulation often reveals counterintuitive trade-offs that can lead to unexpected losses.

What operational blind spot affects preference systems?

While the pattern may seem stable, a central operational blind spot still turns what appear to be effective preference systems into sources of false confidence.

How to Use an Investment Preference Tool

An investment preference tool helps translate financial goals into repeatable decisions. It is essential to verify whether those decisions actually lead to better results. Users should adjust the tool to match how they really act. Running live tests against a baseline is key to assessing how well it works.

Also, good governance helps ensure the recommendations remain useful during tough times, so they don't become background noise.

How should I align the tool with what I actually do?

After a six-week integration with a mid-sized registered investment advisor, reconciliation time was reduced from two days to two hours. This was done by matching real trading events to preference outputs and giving less importance to recent behavior.

Start by running the tool in shadow mode for at least one complete market cycle. Tag every override with a short reason and assign decreasing weights to revealed actions, making sure that yesterday’s panic does not control next month’s plans.

Use specific behavioral anchors; for example, set the system to pause automated sells after three aborted orders or require a staged order size for emotional trades. This way, the tool can help encourage better choices without becoming a permanent replacement for judgment.

How can I demonstrate that the tool improves performance?

Treat the preference engine like an experiment, not a matter of faith. Hold back a control portfolio or account while you try out the tool’s recommendations on a shadow copy. Track the hit rate, net return after fees, and tax drag for at least 90 days. Compare execution-cost-adjusted returns and monitor regret metrics, such as how often corrective trades occur within 30 days.

If your test shows steady improvement in signal precision and fewer reactive trades, you will have proof that the tool provides an advantage. On the other hand, if it only increases activity without a net gain, consider tightening filters and shortening the decision window.

How do I stop alerts from becoming noise?

Noise happens when every small signal creates a notification. To reduce this, group lower-priority suggestions into a weekly summary. Set a minimum conviction threshold for when notifications should interrupt you. Assign role-based approvals so that only critical recommendations require human sign-off.

Export raw events to a local analytics sandbox; this way, you can re-score signals without changing the live system. Use a single suppression control to silence a group of related alerts until the following scheduled review.

What governance and safety checks actually matter?

Implement time-locked rules and audit gates to improve governance. For taxable accounts, set up tax-sensitive windows that stop the automated realization of short-term gains without an explicit override. Require a second sign-off for trades that go beyond concentration limits.

Also, keep immutable logs of every recommendation, including the machine score that generated it and the human rationale for any overrides. Finally, create agreed-upon data scopes to ensure that external integrations receive only the information they need. This method helps maintain both compliance and customer trust.

How should I integrate a preference tool with other systems?

Start by mapping identifiers, then stream events. When a preference feed was connected to the custody and accounting systems of a small advisory firm, matching trade IDs and timestamps in advance reduced reconciliation mismatches by 80 percent during the pilot phase. Storing raw, timestamped events while keeping a versioned history of preference-model parameters ensures accuracy. Running nightly replays helps keep downstream reporting consistent when models are updated.

If your broker doesn’t have APIs or clear exposure breakdowns, consider exporting CSV snapshots and importing them into a simple visualization tool to restore missing charts until your integrations are updated.

What do everyday users feel, and why does it matter?

Clients become exhausted when they have incomplete transaction histories or no clear visuals of their exposure. This exhaustion can cause them to lose trust faster than even a slight loss would affect their money. A typical pattern appears across custodial and retail platforms: users feel vulnerable when they can move large amounts of money, and their records appear disorganized. As a result, they often move to tools that provide auditable actions and clear explanations.

It's essential to design your preference workflow to show the reasons behind each recommendation, not just the ranking. This method helps users feel respected and in control.

What to consider for adoption and scalability?

Adoption is accelerating, raising expectations for reliability and user experience.

According to the BlackRock Investment Survey, 75% of investors prefer using digital tools for investment decisions.

Therefore, it's vital to build for scale and explainability from day one.

Real-world usage stress tests become crucial at scale. According to BlackRock Usage Data, more than 50 million users have accessed the investment preference tool since its launch.

This highlights the variety in user behaviors. To manage this complexity, expect your models to face different behaviors and edge cases. Therefore, plan for conservative defaults and set up fast rollback controls.

What checklists are essential for success?

There are two essential checklists: a technical checklist and a human checklist. To succeed, you should version your models, create a shadow test, enforce audit gates, and keep simple human overrides that are not punitive. By using these four strategies, the tool will shift from a source of noise to a measurable lever for better decisions.

What is the most challenging decision?

While that may seem tidy, the more challenging choice is selecting the tool that aligns with your rhythm and risk appetite. The next question may prompt you to reconsider everything you believed was important.

Related Reading

- Dividend Coverage Ratio

- What Are the Key Financial Ratios

- Fundamental Value

- Fundamental Stock Data

- Best Fundamental Analysis Tools

- Stock Analysis Apps

- Types of Fundamental Analysis

- Balance Sheet KPIs

How to Choose the Right Tools

Choosing tools is like running a short experiment. First, decide on the criteria you will use to make your decision. Next, evaluate the options against those criteria and select the vendor that meets both technical and user-friendly requirements. Focus on measurable fit rather than just feature lists; the best tool is the one that fits your process, not just the one with the most impressive demo.

What should I test in a trial?

Start with a compact checklist that can be completed within a single account or sandbox in 7–14 days. Test three critical aspects: Can the tool ingest your live portfolio and produce actionable recommendations in under a business day? How often do you override recommendations, and what are the reasons for those overrides?

Finally, how long does it take an average user to go from signing up to executing their first guided action? These outcomes reveal whether the product effectively reduces friction or merely rearranges it.

This approach is practical: run the same scenario across two vendors, track time-to-decision, and note the reasons for overrides. Favor the vendor that offers a lower cognitive load and more explicit rationales.

Which integration failures silently kill adoption?

This problem appears in retail rollouts and advisory pilots: adoption fails not because of user interface issues, but because identifiers and connectors do not align. Check three integration realities during evaluation, not later. First, confirm identifier normalization: the tool consistently maps your broker tickers, account IDs, and foreign securities. Second, request sample API logs that demonstrate idempotent behavior, so retries and replays do not create duplicate trades or exposures. Third, verify the refresh cadence and rules for resolving conflicts caused by mismatched data.

Those technical issues decide whether you get decisions you can act on, or just a reconciled spreadsheet and a headache. Also, because data quality is important, note that 70% of companies report improved data quality after implementing automated data quality tools, which explains why built-in validation should be a must-have rather than an optional add-on.

How should I evaluate vendor reliability, support, and hidden time costs?

Evaluate vendor responsiveness just like you would for brokers. Ask for service-level agreement (SLA) commitments for data delivery, incident response, and onboarding milestones. Then, turn these into internal tests that you accept. When running any pilot, determine the number of manual reconciliation hours required each week, both before and after the integration.

Compare this to what the vendor promised. Many teams realize significant savings only after automation is in place. For example, organizations save an average of 20 hours per week by using automated data quality solutions, according to the Metaplane Blog from September 2, 2025. It's crucial to estimate the time you expect to save before signing a contract.

What is the familiar approach, and why does it quietly fail?

Most teams evaluate tools by feature lists and screenshots because that approach is quick and familiar. This method works well at first, but as accounts and edge cases grow, the lack of strong connections and clear incident playbooks leads to more manual work, longer reconciliations, and slower adoption. Solutions like MarketDash offer a bridge by centralizing ranked signals, pre-built integrations, and clear recommendations. This reduction of review cycles from days to hours keeps audit trails and enables human overrides.

What pricing model actually favors growing portfolios?

Models should be compared not by sticker price, but by break-even friction. Create a simple payback table: divide the annual subscription plus implementation costs by projected weekly hours saved to determine the number of months to pay back.

Next, stress-test the table against scenarios such as a 25 percent increase in data volume and a 40 percent increase in user seats to assess how costs change. It's best to prefer vendors that provide predictable unit pricing for connectors and clear change logs for model updates. Unpredictable add-on fees can disrupt budgeting and make it harder to adopt new models.

What behavioral acceptance signals matter most?

Adoption is a human metric. It is essential to track three key signals during a pilot: the ratio of users who follow the tool’s top-ranked recommendation within seven days, the frequency of override reasons tagged with cause, and the rate of repeat usage after market stress events.

If users often override for the same reason, it indicates that the preference model and UI are not aligned, not the users. This pattern happens across many deployments. Tools that pass acceptance tests in calm markets often fail when volatility comes back. To protect yourself, request a brief post-stress review with the vendor specified in your contract.

What is MarketDash?

MarketDash is an all-in-one AI-powered investing and market analysis platform made to help users make smarter investment decisions faster. By starting a free trial, users can see how market analysis reduces research time, keeps records clear, and turns ranked signals into actionable steps.

What happens next after your decision?

While the decision may seem sound, it will soon face a real-world stress test. What happens next will decide if it was the right choice.

Related Reading

- Seeking Alpha vs Morningstar

- Best Portfolio Analysis Software

- Simply Wall St vs Seeking Alpha

- Seeking Alpha vs Tipranks

- Finviz Alternatives

- Stock Rover vs Seeking Alpha

- Seeking Alpha Alternatives

- Motley Fool vs Morningstar

- Finviz vs Tradingview

Try our Market Analysis App for Free Today | Trusted by 1,000+ Investors

You gain a true competitive edge when your tools accurately match your trading style, rather than just providing more alerts. Try MarketDash on a free trial and see how our preference-aware decision engine smoothly combines your rules, risk limits, and real-time signals into one clear recommendation you can trust.

This is like switching from a busy radar to a clear direction that you can confidently act on.