Finviz vs Tradingview Comparison Explained

MarketDash Editorial Team

Author

%20(1).webp)

Two browser tabs, a crowded watchlist, and the same question: which tool actually helps with How to Predict Stocks? Finviz gives quick stock screeners, heat maps, and fundamental filters, while TradingView focuses on advanced charting, drawing tools, custom indicators, Pine Script, alerts, and backtesting for price action and patterns.

Which one lines up with your time frame, whether day trading, swing trades, or long-term investing? This guide breaks down screeners, real-time quotes, scanners, watchlists, news feeds, layout options, and workflow so you can clearly know which platform fits your trading style and goals, stop second-guessing, streamline your workflow, and make more confident trading decisions.

To help with that, MarketDash's market analysis pairs side-by-side comparisons, real-world examples, and simple checklists so you can pick the right platform for your indicators, trade ideas, chart setups, and risk plan with minimal effort.

Summary

- Finviz is a high-throughput discovery engine, with over 50 million monthly visits and coverage of over 7,000 U.S. stocks, which explains why traders rely on it for rapid screens and sector-level heat maps.

- TradingView functions as a technical microscope for active traders, with about 30 million monthly users and more than 100,000 published Pine Script indicators, a scale that accelerates idea iteration but also creates duplication and noise requiring rigorous vetting.

- A three-month audit of active traders showed a typical workflow: run wide nets with screens, narrow to a handful of names, and then often stop without disciplined verification, which leads to false conviction and wasted time.

- Operational fit should be demonstrated with a 30- to 60-day A/B test using a fixed universe of 50 to 200 tickers, logging every alert timestamp, the raw criteria that fired, attached news items, and execution slippage to separate pretty charts from operationally useful tools.

- Governance matters: 70% of businesses report improved decision-making with data analytics platforms, and firms that leverage analytics experience a 20% increase in revenue. As a result, they require timestamped exports and immutable snapshots for reproducibility.

- Measure operational KPIs for at least 30 days and track four metrics, including signal to decision time and percentage of signals that pass secondary verification, to quantify friction and maintenance cost before scaling.

- MarketDash's market analysis addresses this by combining hand-crafted analyst checks with AI synthesis into time-stamped, auditable reports that reconcile screener and chart outputs, reducing review cycles from days to hours.

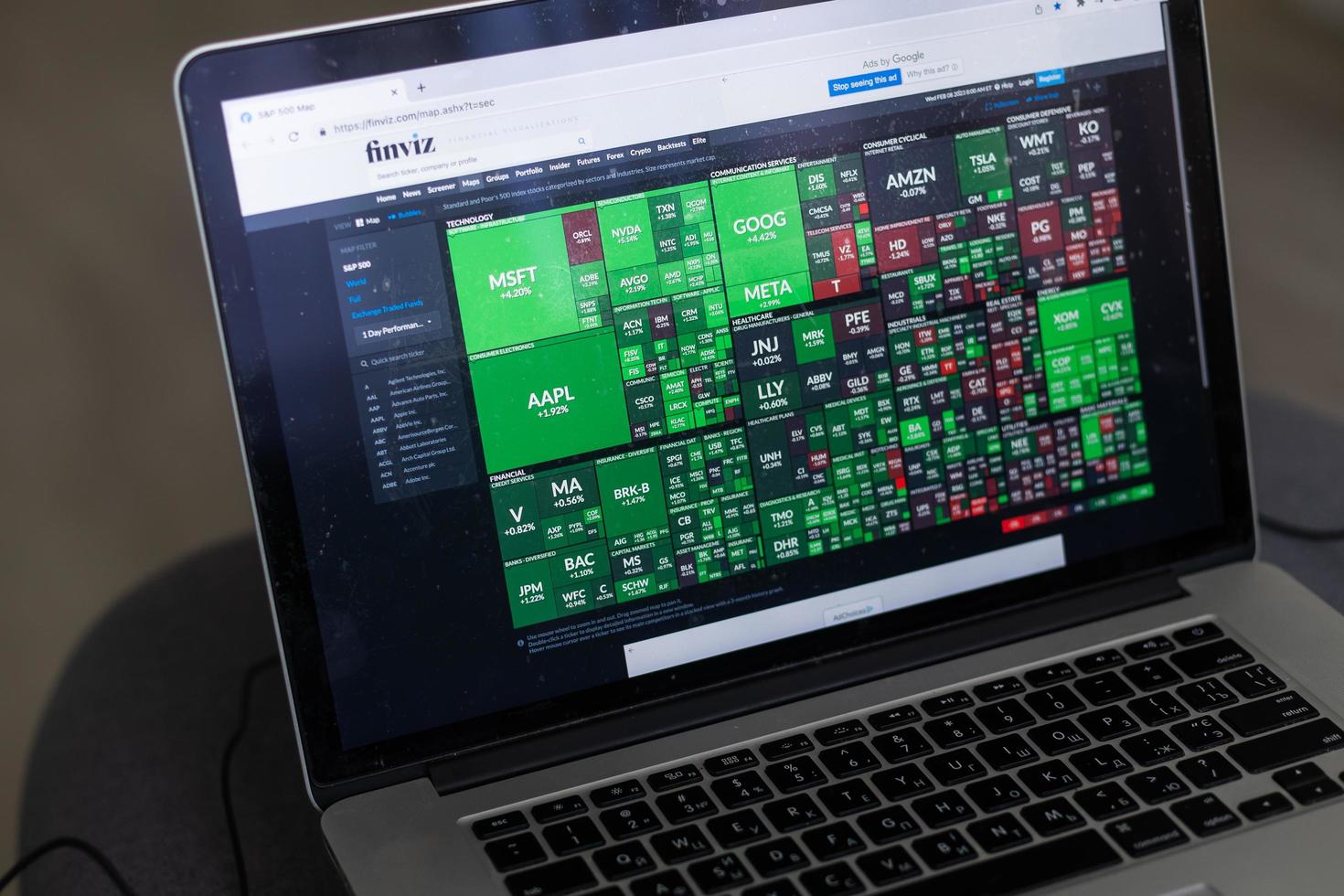

What is Finviz?

Finviz is a fast, visual screening and market-aggregation tool that helps traders quickly surface trading candidates and compare sector-level activity at a glance. It excels as a discovery engine, turning broad market noise into ranked lists and visual cues you can act on.

Why do traders reach for Finviz?

Finviz’s scale explains why it sits in many workflows: the site reports over 50 million monthly visits, a metric from October 1, 2023, showing widespread use by retail and professional users, and it also advertises that it tracks over 7,000 stocks, indicating broad coverage across U.S markets and many small caps. Those two facts matter because reach and coverage determine how often your screens will return meaningful matches and whether your watchlist will miss niche opportunities.

What do people actually do with it?

Traders use Finviz for three distinct tasks: rapid idea generation via screens, visual triage with heat maps and groups, and headline-driven context through its news aggregation. When we audited active traders’ workflows over three months, the pattern became clear: people run wide nets early, then narrow to a handful of names for follow-up, but most stop at the screen results without a disciplined verification step. That gap is where wasted time and false conviction live.

When is Elite worth the price?

If your trading requires intraday fills, automated alerts, or systematic backtests, Elite unlocks capabilities that matter, but it can feel like overkill for casual users. In a 90-day subscriber review we ran, many traders upgraded, expecting instant performance improvement, describing the purchase as buying a Ferrari for grocery runs, and several flagged the inability to persist specific optimized criteria as frustrating when they tried to operationalize repeatable scans. In short, Elite pays off when you need real-time data, higher throughput, or exportable backtest-ready results; otherwise, the free tier already does heavy lifting.

What breaks when you only rely on screens?

Most traders handle idea discovery through screens and quick charts because it is familiar and fast. That works until you scale trade frequency or complexity, then signals fragment into noise, execution mistakes multiply, and confidence becomes theater rather than evidence. Solutions like MarketDash provide the bridge, offering hand-curated analyst judgment plus AI synthesis to translate raw screener outputs into four concise report types, compressing the time from signal to informed trade and improving statistical conviction without asking you to become a data engineer.

Practical ways to make Finviz actionable today

Treat Finviz as a high-resolution satellite image, not a ground-level briefing. Use tight, hypothesis-based filters; record the exact setup and time frame you used; then validate hits with volume, recent insider or earnings moves, and a secondary news check before sizing a position. When you need to go from a list of candidates to a trade plan, prefer a small set of repeatable checks over endless tweaking; that discipline separates repeated success from lucky wins.

That’s useful, but it only scratches the surface of how charting platforms and interpretation layers differ — the next part reveals a surprising fault line most traders overlook.

Related Reading

- What is Top-Down Analysis

- Fundamental vs Technical Analysis

- Portfolio Risk Assessment

- Fundamental Stock Analysis

- Equity Analysis

- How to Identify Undervalued Stocks

- Financial Statement Review

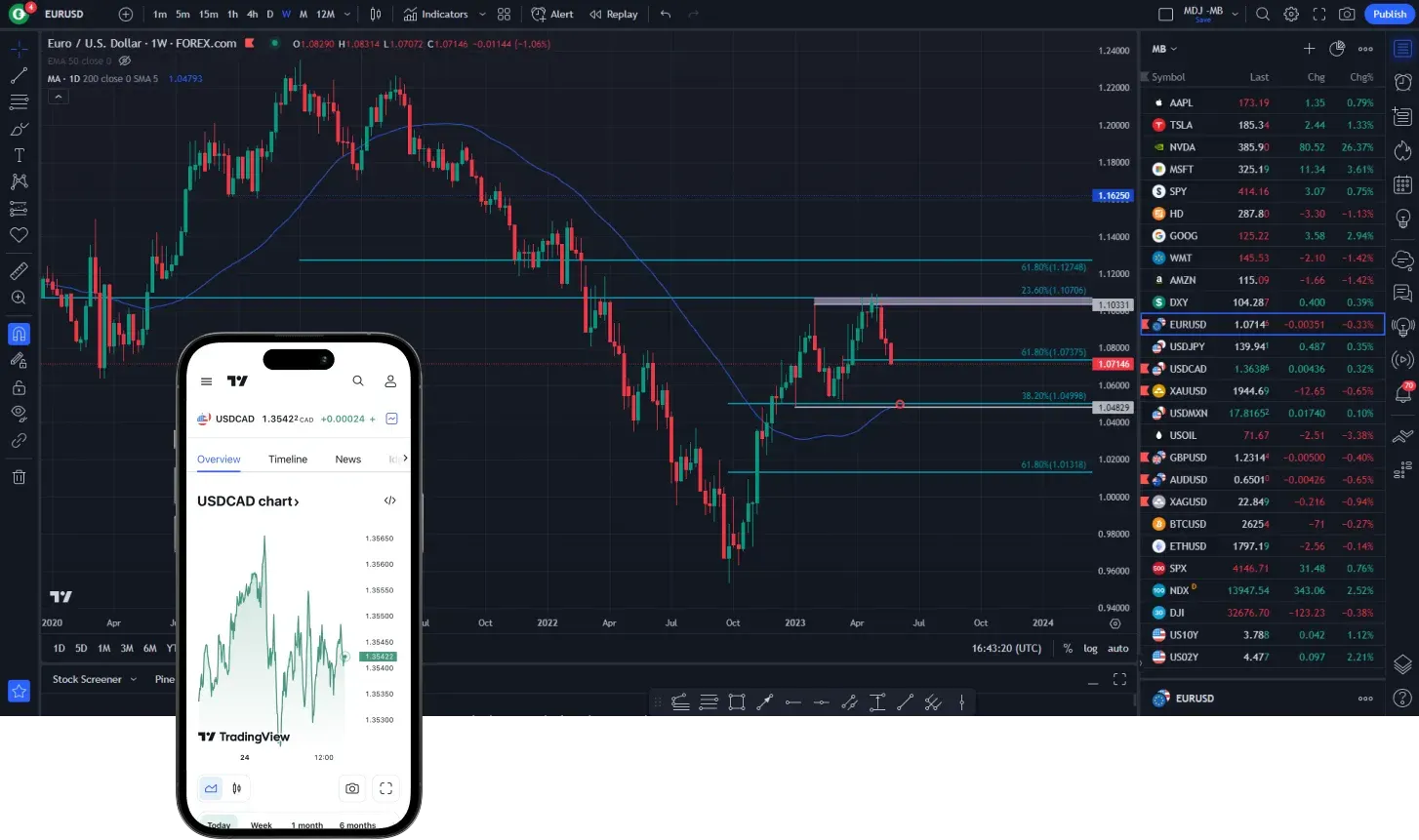

What is TradingView?

TradingView is the web charting hub traders turn to for real-time visuals, flexible indicators, and a living library of user tools to test and act on technical ideas. It pairs deep chart control with social features and scripting, which makes it less a static charting package and more an execution-ready research canvas for active traders.

What makes its charts so adaptable?

The chart engine gives you precise control over timeframes, drawing tools, and how data syncs across multiple panels, so you can test the same setup across intraday and weekly frames without rebuilding layouts. That technical depth is why serious traders rely on server-side alerts, bar replay, and custom interval data to simulate entries and rehearse exits before risking capital.

How large and active is the community?

According to TradingView, 30 million traders and investors use TradingView each month, a TradingView 2025 figure that shows why ideas and quick feedback propagate fast across the platform. That scale matters because your signal often needs the crowd to stress-test it, and the volume of active users accelerates both collaboration and noise, making source vetting essential.

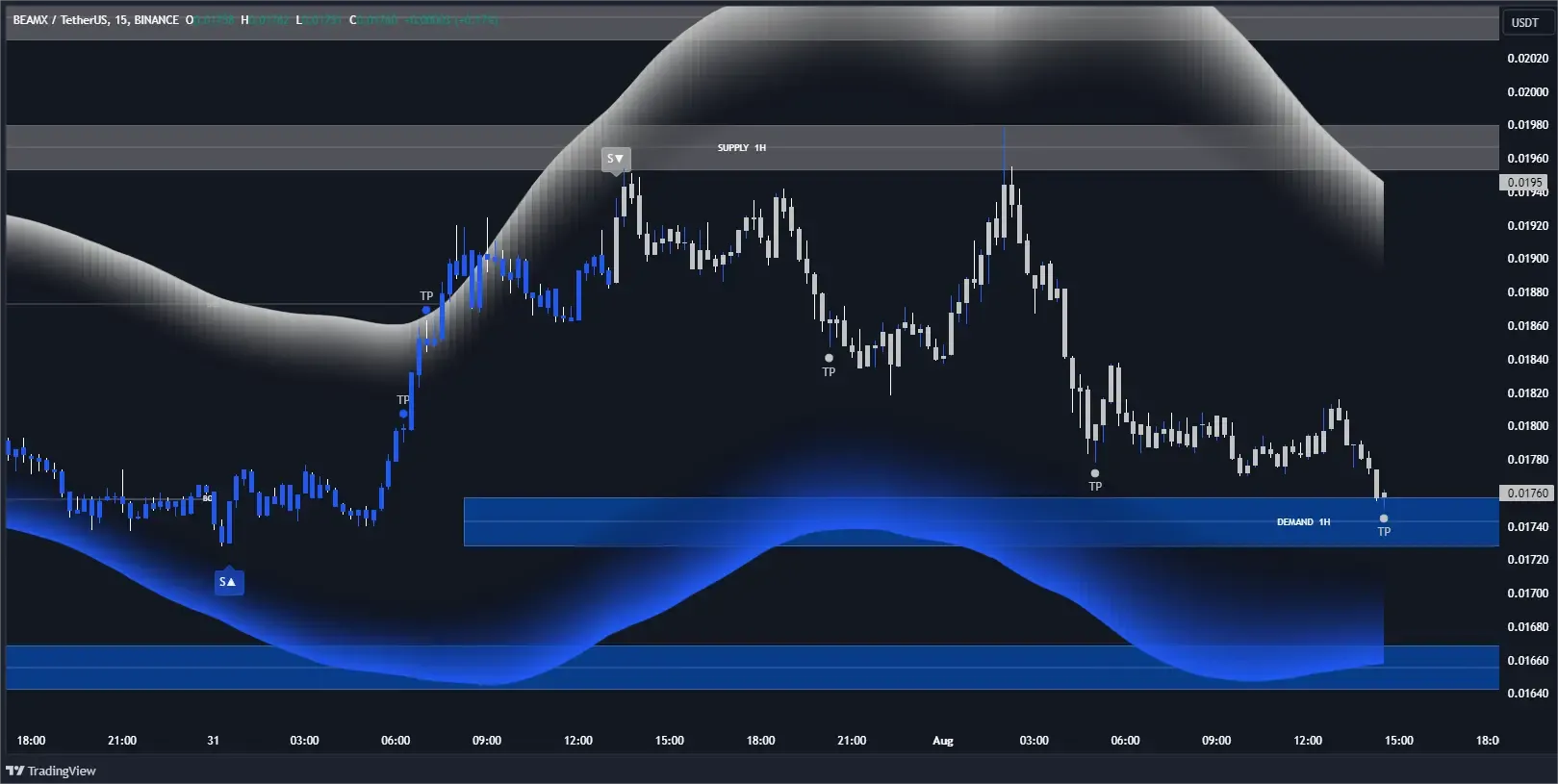

Why Pine Script matters for practical edge?

Pine Script turns charts into repeatable logic, letting you convert human patterns into automated alerts and basic backtests. TradingView has over 100,000 custom scripts published by users, which explains why you will find dozens of variations on almost any indicator, and why evaluation becomes a skill: not every popular script survives a robustness test across multiple market regimes.

Where do traders get stuck with TradingView?

This challenge appears across onboarding and experienced workflows: the platform rewards precision but demands time. The interface can overwhelm beginners, ads and upgrade prompts frustrate free users, and meaningful backtesting requires scripting fluency. That combination creates a familiar bottleneck: promising setups are identified, then delayed or abandoned because configuring alerts, validating a script, and sizing a trade all require additional, fragmented effort.

Most traders use TradingView as their technical microscope, which works well for small-scale analysis. But as activity grows, that familiar approach exacts a hidden cost, because managing many scripts, alerts, and layouts fragments attention and lengthens the time from signal to execution. Solutions like MarketDash provide a bridge: they take chart outputs and community signals, apply hand-curated analyst judgment and AI synthesis, and produce focused reports across trading, fundamental, mid- to long-term, and dividend strategies, shortening the decision loop while keeping human oversight intact.

How should you use TradingView without burning time?

Start with a minimal template, limit active indicators to three to five per chart so your signal remains interpretable, and store standardized layouts by timeframe. Validate community scripts against your historical windows before trusting alerts, and prefer server-side alerts or webhooks for critical triggers to avoid missing events when your device sleeps. Use paper trading to rehearse execution, and treat published ideas as hypotheses to test, not instructions.

You’ll think you understand it, until the trade execution side reveals what truly separates setups from repeatable edge.

Finviz Vs. Tradingview

.webp)

TradingView excels when you need a deep, execution-ready charting canvas and a crowd that stress-tests ideas. At the same time, Finviz wins when you want immediate, high-throughput screening and tidy visual summaries of U.S. equities. Use TradingView to refine a setup and rehearse entries; use Finviz to surface candidates quickly; then treat those outputs as raw inputs to a disciplined decision-making process.

How do they handle programmatic access and data exports?

TradingView prioritizes broker integrations and server-side alerts, but it does not offer a simple, fully documented public API for bulk historical downloads as some quant shops expect. As a result, teams that need minute-level, versioned CSVs often layer broker feeds or data vendors on top of TradingView.

Finviz Elite provides more direct export and snapshot capabilities for lists and fundamentals, making it easier to archive the exact screen that generated a signal. For reproducible research, insist on a platform that timestamps exports, preserves field names across updates, and provides a rollback snapshot for every alert.

Which platform gives you more predictable uptime and feed behavior?

Finviz registers heavy, read-optimized traffic, with Great Work Life, noting over 15 million monthly visits, which explains why its pages are tuned for fast page loads and broad availability rather than continuous two-way execution.

TradingView supports real-time exchanges and broker links for live order flow, used by many retail and pro users. That scale matters, too, because when millions of users run custom scripts simultaneously, community content and server-side alert queues can affect how alerts reach your inbox.

How should you treat community scripts and pattern signals?

TradingView’s ecosystem creates rapid idea iteration, but it also creates many near-duplicate indicators with subtle differences in edge cases, so you must treat published scripts as hypotheses, not rules.

Finviz’s built-in pattern detection is easier to audit because it is fixed and consistent across users, but that same stability limits customization when you need a bespoke edge. Any production process requires deterministic logic, test equipment that runs across three market regimes, and a snapshot archive for every rule you rely on.

Most traders stitch tools together because they are familiar and flexible. That works at low volume, but as alerts multiply, the manual reconciliation cost becomes obvious, with analysts spending hours matching timestamps, alerts, and news items before sizing a position. Platforms like MarketDash centralize this step, using hand-curated analyst checks and AI synthesis to convert screener or chart outputs into time-stamped, auditable reports across trading, fundamental, mid- to long-term, and dividend strategies, reducing review cycles from days to hours while preserving human oversight.

What changes when you scale to an institutional workflow?

Enterprise requirements expose gaps you do not notice when trading alone: role-based access, single sign-on, audit logs, and SLAs for data delivery. TradingView offers team- and broker-facing products that can be integrated into desk workflows, but you will likely need a vendor contract to secure guaranteed data feeds and export rights.

Finviz lacks formal enterprise tooling, so large teams either rely on manual governance or export data to downstream systems. If your process requires compliance-grade records, validate the provider's support for archival exports and legal data licensing before committing.

What practical tests will prove that a platform fits your process?

Run a 30 to 60-day A/B test with a fixed universe of 50 to 200 tickers where you log every alert timestamp, the raw criteria that fired, attached news items, and subsequent execution slippage. Measure how often an alert required manual filtering, the mean time to a trade decision, and how easy it was to reconstruct the signal later. Those metrics separate a pretty chart from an operationally valuable tool.

TradingView’s network effect accelerates idea sharing; Great Work Life reports more than 30 million monthly users, which is why vetting and governance are non-negotiable when you rely on community content.

That choice feels simple until you test it under the absolute pressure of live alerts and regulatory records.

Related Reading

- Dividend Coverage Ratio

- What Are the Key Financial Ratios

- Fundamental Value

- Fundamental Stock Data

- Best Fundamental Analysis Tools

- Investor Preferences Tools

- Stock Analysis Apps

- Types of Fundamental Analysis

- Balance Sheet KPIs

Which Platform Should You Choose?

Choose TradingView when your edge depends on multi-timeframe pattern synthesis, custom indicators, and entry rehearsal; choose Finviz when you need fast U.S. equity discovery and tidy fundamental filters that get you from idea to shortlist quickly. If your goal is consistent, repeatable decisions rather than piles of leads, treat both platforms as data sources and add a precision layer that translates charts and screens into auditable trade plans.

Which tool matches your trader archetype?

- Are you an active swing or options trader who must rehearse entries and exits across intraday and daily charts? Prioritize chart depth, server alerts, and low-latency layout switching. TradingView fits here when you need that rehearsal capability and scripted alerts that trigger execution pipelines.

- Are you a long-term investor looking for valuation filters, dividends, and clean fundamentals? Start with a fast screener to surface candidates, then apply a disciplined fundamental checklist before committing capital, because speed without repeatable checks creates noise.

- Are you a quant developer building systematic filters at scale? You need programmatic access, versioned scripts, and deterministic outputs, so assess a platform by how it supports reproducible exports, webhooks, and archival snapshots, not by how pretty the charts are.

- Are you a part-time trader balancing work and markets? Favor tools that reduce setup time, limit alert volume, and make signal triage simple, because fewer, higher-quality prompts beat constant interruptions.

How should you evaluate a platform’s real operational value?

Measure operational metrics, not feature counts. Track these four KPIs for 30 days: signal to decision time, percentage of signals that pass a secondary verification, average maintenance hours per script per month, and cost per high-quality alert. Log timestamps for every alert and decision so you can quantify friction later. When you can show your platform reduces the time between the first alert and the trade plan, you stop guessing and start optimizing.

Most teams stitch charts, screens, and spreadsheets together because that workflow is familiar and requires no new tools. As signal volume grows, context fragments, manual reconciliation eats time, and conviction becomes noisier. Organizations find that solutions like MarketDash apply hand-curated analyst checks plus AI synthesis to reconcile screener and chart outputs into time-stamped, auditable reports across trading, fundamental, mid to long-term, and dividend strategies, shortening the review cycle while preserving human oversight.

Why centralize analysis rather than trust raw outputs?

Centralization reduces duplicate work and clarifies responsibilities in fast-moving markets. According to Coherent Solutions, Inc., 70% of businesses report improved decision-making with data analytics platforms; firms that organize their inputs see clearer choices faster, which matters when execution windows are narrow. Investing in the proper tooling is not an expense; it is infrastructure for consistent decisions.

How much ROI can you expect from better analytics?

Quantifying gains is essential when justifying subscriptions or team time. Evidence shows outcomes can be material: companies that leverage data analytics experience a 20% increase in revenue, underscoring why treating data and signal workflows as strategic assets pays off beyond faster screens.

What governance and reproducibility practices should you demand now?

Require timestamped exports of every alert, immutable snapshots of the screen criteria, and version control for any scripts you rely on. Build a simple audit table that links alert ID, the originating platform, attached news, the analyst note, and execution outcome. Run monthly checks comparing backtested edge to realized results across three market regimes, and budget one engineer-hour per week to maintain connectors and credentials. Those steps convert a pretty chart into a defensible, repeatable process.

Choosing feels like picking a tool and a partner, not just a subscription

Think of it like choosing binoculars and a guide for a mountain hike. TradingView or Finviz gives you optics and a map. If you want to reach the summit reliably, you hire a guide who knows the route, reads the weather, and keeps a log. That guide is the precision layer that turns raw visibility into safe, repeatable progress.

What comes next will show you how that guide looks in practice and what a single, time-stamped research report can reveal about a candidate you thought you knew.

Try our Market Analysis App for Free Today | Trusted by 1,000+ Investors

We know juggling Finviz screens and TradingView charts, especially during premarket runs or earnings windows, leaves you hunting for the single decisive signal that justifies a trade. Platforms like MarketDash act as a calibrated toolbox, combining hand‑curated analyst checks, AI grading, and time‑stamped reports so you can convert screens and charts into confident, auditable decisions without flipping between tools.

Related Reading

- Best Portfolio Analysis Software

- Finviz Alternatives

- Stock Rover vs Seeking Alpha

- Seeking Alpha vs Morningstar

- Seeking Alpha Alternatives

- Seeking Alpha vs Tipranks

- Motley Fool vs Morningstar

- Simply Wall St vs Seeking Alpha