Seeking Alpha vs. Tipranks Comparison Guide

MarketDash Editorial Team

Author

Investors eager to learn how to predict stocks often face a barrage of analyst ratings, price targets, and conflicting recommendations. They must sift through data from multiple sources to determine which insights are most trustworthy and useful. A streamlined approach in comparing platforms like Seeking Alpha and Tipranks can reduce research overload and expedite smarter investment decisions.

Consolidating consensus ratings, sentiment scores, earnings forecasts, and historical performance into one clear view transforms complex market data into actionable insights. MarketDash's market analysis offers tools that integrate critical metrics, enabling more efficient and confident investment strategies.

Summary

- Seeking Alpha’s crowd-sourced model delivers depth and rapid feedback, driven by over 7,000 contributors and a monthly audience exceeding 20 million, which creates rich signal density but also amplifies conflicting takes you must filter.

- Across a six-month stretch of managing actively traded portfolios, earnings coverage on long-form platforms often read like highlight reels rather than sequential narratives, showing quick beat or miss summaries but limited contextual changes quarter to quarter.

- TipRanks’ strength is quantifiable triage: it tracks over 7,000 financial analysts and ranks sources by historical win rate and return per call, which makes it efficient for pruning watchlists but not for building full theses.

- Practical testing with retail investors over one month found that treating aggregated scores as decisions rather than inputs creates concentration risk, because tidy rankings can mask underlying business fundamentals and position-sizing errors.

- AI and real-time analytics materially change workflows, with platforms that layer AI-driven insights seeing a 50% increase in user engagement and, in some studies, 80% of users reporting improved decision-making from real-time data.

- MarketDash addresses this by combining hand-curated analyst selection, AI-driven synthesis, and a structured four-report workflow to translate crowded signals into auditable, trade-ready outputs.

What is Seeking Alpha, and How Does It Work?

Seeking Alpha is a community-driven investment research platform that brings together many independent analysts and provides scoring and algorithm-based tools. Users can read diverse opinions, view numerical grades, and track combined crowdsourced analysis, earnings documentation, and quantitative metrics to help investors turn raw information into actionable insights, all in one place.

It combines crowdsourced analysis, earnings documentation, and quantitative metrics to help investors turn raw information into actionable insights. For deeper insights, consider our market analysis to help inform your investment decisions.

How is content created and vetted?

When contributors publish, editors check submissions for clarity and relevance. Then, the community reviews the piece through comments and monitors its performance. Seeking Alpha has over 7,000 contributors. You get a wide range of expertise, from specialists in different sectors to retail traders. This creates both depth and noise depending on who you choose to follow.

How big is the audience, and why does that matter?

The platform’s size is important for signals and social proof: Over 20 million people use Seeking Alpha every month.

This large audience enables faster responses to articles, quicker discovery of new ideas, and more data to evaluate contributor skills. However, it also highlights conflicting perspectives that users must actively filter.

Why does earnings coverage feel thin sometimes?

When preparing actively managed portfolios over a six-month stretch, earnings call coverage often looks like a highlight reel. It summarizes successes or failures without explaining how the company’s story actually changes from quarter to quarter.

This pattern is consistent: transcripts and quick recaps present facts quickly; however, sequential narrative shifts, tone changes, and management rhythm receive less emphasis. This lack of depth leaves traders wanting a more complete, context-rich interpretation.

How do the quantitative scores complement opinions?

Seeking Alpha’s proprietary quant grades combine factors such as value, growth, profitability, and momentum to create a single rating that sits beside each stock’s commentary. The grades act as a filter, not a verdict; they help you decide which articles to read first and which stocks need model-level diligence before you invest your money.

The best strategy is to pair a strong quant score with a clear, evidence-based thesis from a contributor with a reliable track record in market analysis.

What are the practical workflows for active investors?

Most users build watchlists, set alerts for earnings and ratings changes, and follow high-performing contributors. This process continues until the number of alerts and articles becomes too high to manage. It’s like trying to cook a gourmet meal while someone keeps tossing new ingredients onto the counter; a good system tells you what to chop first and what can wait.

Many investors gather everything because it seems complete, and this approach makes sense. But as alerts increase and opinions clash, time runs out, and the quality of decisions decreases.

Opportunities slip away while sorting through the noise. Solutions like MarketDash, which combine hand-curated analyst selection with AI-driven synthesis and a structured four-report workflow, enable teams to distill research into trade-ready ideas and maintain consistent portfolio building, without sacrificing the insight of expert judgment.

Who gets the most value from Seeking Alpha?

It serves diligent retail traders seeking diverse views and income investors seeking payout analysis. Analysts gain from fast access to transcripts and event calendars.

For investors who need trade-ready signals instead of just raw analyses, the platform’s diversity of voices and quick commentary are impressive. However, a potential downside is the additional effort required to translate these opinions into a well-organized portfolio plan.

What is the overall takeaway on using Seeking Alpha?

Think of Seeking Alpha as a busy debate hall with a scoreboard. The discussion is lively and quick, and the scores guide you to important topics. However, someone needs to synthesize the best arguments into a clear position you can act on.

This contradiction, the very useful information, and the quiet work needed to turn it into clear trades raise an important question to consider next.

Related Reading

- What is Top-Down Analysis

- Fundamental vs Technical Analysis

- Portfolio Risk Assessment

- Fundamental Stock Analysis

- Equity Analysis

- How to Identify Undervalued Stocks

- Financial Statement Review

What is TipRanks, and How Does It Work?

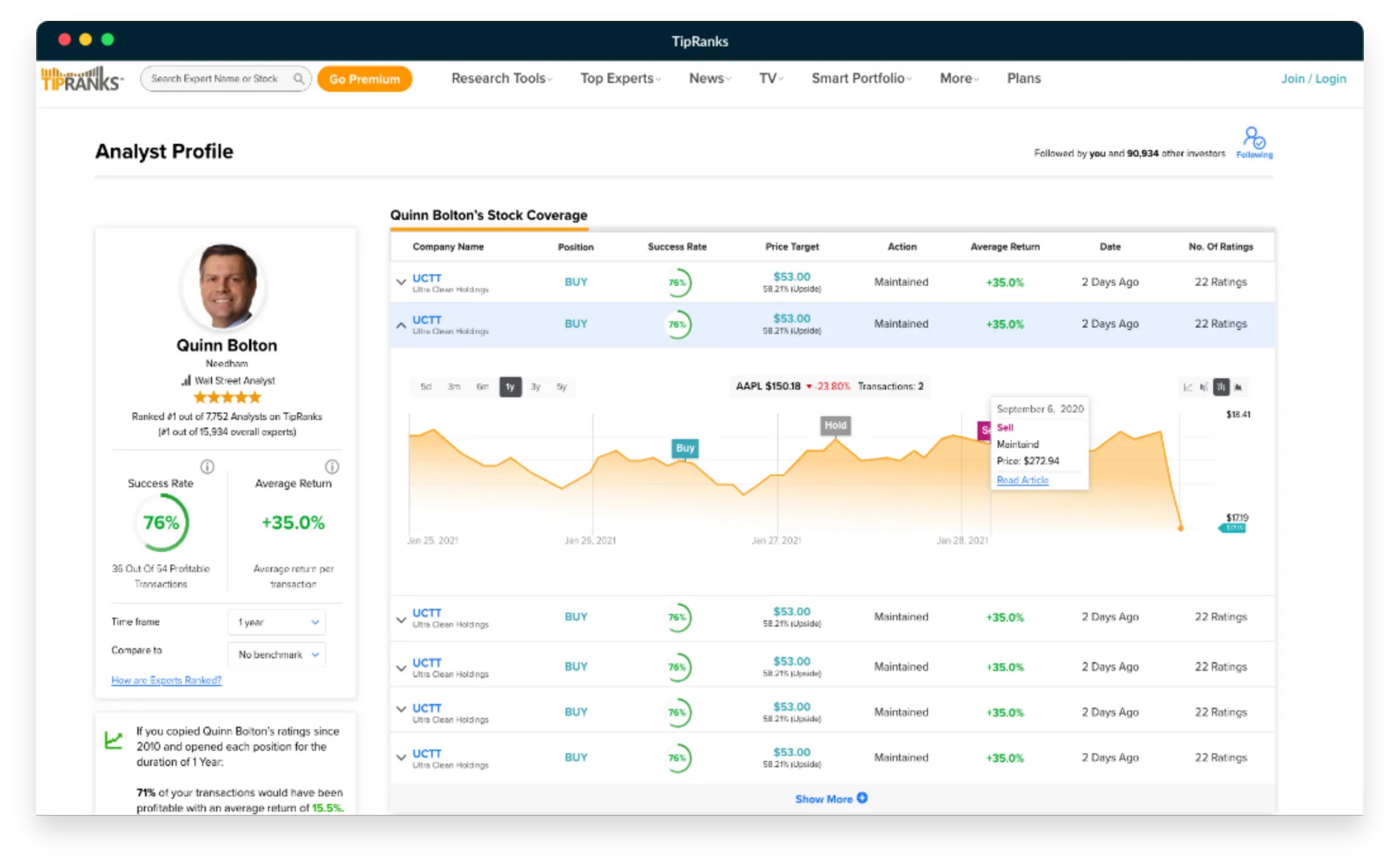

TipRanks is a signal aggregation engine that grades advice based on results rather than reputation. It gathers public data from analysts, insiders, funds, and media sentiment. Then it scores each source based on its past accuracy and combines these scores into a single stock rating. This helps users see which recommendations actually made money.

For those interested in a deeper understanding of the data insights, our market analysis further supports these recommendations.

How does TipRanks score individual experts?

TipRanks looks at sources based on their past performance: win rate, average return on each call, and consistency over time, and then ranks them on leaderboards. Since TipRanks tracks a large number of contributors, it can reveal recurring patterns. TipRanks monitors over 7,000 financial analysts, according to IG International, so its expert leaderboard reflects a wide range of professional insights rather than just a few outliers.

What signals get folded into a stock rating?

The platform combines several clear signals, such as analyst price targets and upgrades, insider buys and sells, changes in big funds, the media's view on the name, and technical overlays. This complete mix is used across a large number of stocks. TipRanks covers more than 5,000 stocks, according to IG International. As a result, users can look up scores for large caps and many small- and mid-cap names without leaving the tool.

Where does TipRanks help investors, and where can it mislead?

When MarketDash worked with retail investors building watchlists over a month, a clear pattern emerged: TipRanks excels at triage, helping users quickly prune stock options. However, the failure happens when users treat the scores as a substitute for a complete thesis.

This shortcut may seem helpful until a concentrated loss occurs; the emotional impact is greater because the signal looks neat but lacks important context. It is tiring to see someone trust a 'top-ranked' call, only to find out they never linked the score to business fundamentals or risk sizing.

What is the hidden cost of aggregated scores?

Most investors depend on aggregated scores because they save time and seem objective. However, as portfolios grow or time horizons get longer, many signals often disagree.

Alerts pile up, and this quick filtering can create a false sense of comfort. It masks the important work needed to turn a ranked idea into a tradable position.

How do teams bridge the gap without starting over?

The familiar approach involves using TipRanks as an initial filter, followed by careful checking of fundamentals and scenario risk. While this method works well at first, it tends to fall apart as things get more complex and alerts pile up.

Solutions like MarketDash offer a helpful connection: teams find that blending handpicked analyst selections with AI analysis, structured into a recurring four-report workflow and weekly opportunity lists, simplifies post-filter work into trade-ready ideas.

This process keeps the subtle details that TipRanks' raw score can't show.

How should you use TipRanks day-to-day?

Treat it like a filing clerk, not a decision maker. Use the leaderboards to decide which analyst calls to read first.

Watch insider trades for conviction signals, and set alerts for changes in top-rated names. Always combine a TipRanks score with a short note that explains why you would buy, what could break the thesis, and how large a position you would allocate.

What do the deeper mechanics change about trust?

Feeling confident on the surface can be pleasing. But the way these platforms create and value signals really changes which scores we can trust.

Seeking Alpha vs. Tipranks

These platforms differ in how they translate signals into action. One gives detailed stories and ratings that you need to understand, while the other provides scored, timestamped events that can be sorted quickly.

Your choice should depend on whether you want trade-ready consistency right away or richer qualitative insights that you will need to put into a plan.

When deciding between Seeking Alpha and TipRanks for stock research, investors often consider how well each service helps without acting as a broker. Both tools gather market data to help make better portfolio decisions. This comparison uses user feedback from trusted sites such as Stockbrokers.com and Trustpilot, ensuring the details reflect real experiences and verified features.

What are the core similarities between the platforms?

Seeking Alpha and TipRanks both serve as hubs for gathering external financial details. They present this information in ways that help everyday traders make informed decisions. Neither platform handles actual transactions; instead, they focus on research to inform strategies without executing them directly.

Users appreciate how both options provide access to aggregated info like ratings and trends. Key points of distinction emerge in their delivery methods.

For example, while there are overlaps in basic screening and alerts, the depth and focus of each platform vary, influencing which option is better suited to specific investing styles.

How do they approach analyst information?

Seeking Alpha emphasizes detailed written pieces from many independent writers. These pieces cover topics such as company earnings, valuation assessments, sector trends, and potential pitfalls. This format allows for thorough explorations, but it can also lead to different opinions that require personal judgment to navigate.

In contrast, TipRanks focuses on tracking professionals from Wall Street, fund managers, and company executives. By looking at their past accuracy, TipRanks builds credibility. This method makes it easier to trust by highlighting proven track records, reducing the need for users to independently verify each source's reliability.

What methods do they use for recommending stocks?

Seeking Alpha provides recommendations based on a mix of authors' opinions and its automated Quant system. This system sorts stocks into tiers such as top buys or neutrals based on various metrics. These updates occur frequently, providing a quantitative perspective alongside qualitative input.

TipRanks, on the other hand, uses its Smart Score, which ranges from low to high. This score includes expert opinions, internal trades, fund changes, media tones, chart patterns, and key financials. This detailed method provides a clear view of market sentiment, making it easier to gauge overall sentiment at a glance.

How do their screening features and user customization compare?

Both services include stock filters in their subscription plans. However, Seeking Alpha's tools are closely tied to its unique scoring system. This system evaluates factors, payouts, and worth estimates.

This setup benefits those who know the system's details. It enables precise sorting based on proprietary criteria.

In contrast, TipRanks' filters focus on mood-based elements. These include group agreements among experts, executive purchases, institutional involvement, and score limits. While these filters are useful for targeted searches, they may feel more limited than broader analytical or pattern-oriented alternatives.

How reliable and trustworthy are the data sources?

Reliability is key in stock tools. Seeking Alpha's open-contribution model can yield mixed results because varying levels of expertise may introduce bias or errors. Users should often cross-check information to ensure accuracy, as the platform relies heavily on community input.

TipRanks uses regulated channels, such as official reports, transaction records, fund updates, and sentiment scans. This standardization makes for straightforward comparisons. The organized approach generally gets higher ratings for consistency and verifiability among reviewers.

What systems do they have for stock notifications?

Alerts keep investors updated on portfolio changes. Seeking Alpha allows users to set up email notifications for rating changes or important company events.

Some feedback mentions inconsistencies in delivery, which could delay reactions to opportunities.

TipRanks informs users of changes in expert opinions, major insider activity, and score changes. It's easy to manage watchlists, which helps users respond quickly, but some users occasionally report minor synchronization glitches.

What extra features does each offer?

Seeking Alpha includes extras like call transcripts, payout evaluations, fund assessments, discussion forums, and sample investment sets in higher plans. These features improve community interaction and provide various resources for deeper dives.

TipRanks offers rankings of expert performers, checks on blogger reliability, overviews of institutional trends, and regular summaries of rating changes. Its easy-to-use dashboard is great for smooth browsing; however, it lacks some collaborative features.

How do the costs and value break down?

Pricing aligns closely with entry-level free access and annual subscriptions starting around $300 for enhanced features.

Seeking Alpha's tiers unlock unlimited articles, advanced metrics, and exclusive lists, making them appealing to readers seeking extensive coverage.

TipRanks' plans provide full score access, detailed tracking, and specialized dashboards, which are ideal for data-focused users. Evaluating the included perks against personal needs is essential to determine the better value. Both platforms offer trials to test fit.

What is the interesting question about consistency under pressure?

That tidy distinction masks a more complex question: how can decisions remain consistent under pressure? This question leads to interesting insights.

Related Reading

- Dividend Coverage Ratio

- What Are the Key Financial Ratios

- Fundamental Value

- Fundamental Stock Data

- Best Fundamental Analysis Tools

- Investor Preferences Tools

- Stock Analysis Apps

- Types of Fundamental Analysis

- Balance Sheet KPIs

Which Stock Analysis Platform Should You Choose?

Who Should Choose Seeking Alpha?

Seeking Alpha is a valuable resource for investors seeking diverse viewpoints and detailed coverage of market opportunities. It’s especially useful for those who enjoy reviewing contributor-submitted pieces that analyze company earnings, discuss valuation models, and highlight both potential gains and hidden risks. This fosters a sense of community, enabling users to share fresh ideas from other enthusiasts and experts.

Such an environment helps intermediate- to advanced-level traders build conviction through qualitative discussions, use quantitative rankings of factors such as profitability and momentum, and access tools to track personal holdings with timely alerts. It is a great option for those seeking detailed insights rather than relying solely on collected data.

Who should choose TipRanks?

TipRanks shines for data-oriented users who prioritize verifiable expert performance and streamlined metrics to guide quick decisions in dynamic markets. It is ideal for retail investors seeking transparency in professional advice.

The platform brings together analyst forecasts, insider transactions, and fund movements into a simple scoring system that ranks stocks on an easy-to-understand scale. This helps users easily identify consensus trends and assess the accuracy of past recommendations.

TipRanks is especially useful for users who want to measure reliability, like tracking how often top performers succeed or connecting news sentiment to price changes.

It suits investors who prefer efficient tools for screening investments, validating trades, and skipping lengthy opinion pieces, relying on facts from institutional sources.

What is MarketDash?

MarketDash is a new AI-driven investment hub that makes it easier for both beginners and experienced users to choose stocks and create strategies for sustainable growth. At its core, the service uses proprietary artificial intelligence to deliver personalized stock recommendations.

It combines fundamental analysis with strategic overviews, including mid-term planning, trading tactics, and dividend-focused approaches, to identify undervalued assets and attractive opportunities.

By adding features such as monitoring insider activity, tracking hedge fund positions, and reviewing Wall Street projections to its automated analyses, it provides actionable, regularly updated reports. This helps investors build portfolios for long-term wealth accumulation while reducing the noise that typically accompanies broader market discussions.

How does MarketDash compare to Seeking Alpha and TipRanks?

Compared with Seeking Alpha and TipRanks, MarketDash stands out by combining Seeking Alpha's community-focused insight with TipRanks' data-driven accuracy. It improves both through advanced AI integration for better guidance.

Unlike Seeking Alpha, which relies on user-written articles that can vary in quality and interpretation, MarketDash offers consistently organized, AI-curated picks that come with SWOT breakdowns and opportunity scans. This new approach helps save time by reducing the need to analyze different opinions.

In contrast to TipRanks, which scores based on expert tracks and sentiment, MarketDash enhances this approach by automating strategy recommendations across timeframes, such as short-term gains or buy-and-hold setups. It also has tracking features for insiders and funds, resulting in a more complete toolkit that connects qualitative stories with quantitative data, all within a user-friendly interface.

Why MarketDash is a better alternative?

MarketDash stands out as a better choice compared to Seeking Alpha and TipRanks. It addresses their shortcomings through smart automation that not only collects data but also generates personalized investment plans. This method makes it easier for users who want results without extensive research.

Practical decision flow you can apply in one minute?

- Constraint: Need speed and compliance.

Action: choose a platform with timestamped events, API exports, and audit logs. - Constraint: Need thesis depth and idea generation.

Action: choose a narrative-first source that allows for annotation and archiving. - Constraint: Need both and want to avoid manual reconciliation.

Action: Choose a hybrid solution that automates synthesis, produces standardized reports, and provides direct exports into your trade tools.

Why choose MarketDash over Seeking Alpha and TipRanks?

While Seeking Alpha may overwhelm users with its amount of subjective content, and TipRanks can feel limited to reactive metrics, MarketDash's AI engine proactively identifies undervalued stocks. It predicts potential surges based on metrics such as cash flow and margins and offers diversified strategies tailored for different risk profiles. This approach can deliver higher returns by focusing on compounding growth.

MarketDash is particularly helpful in fast-paced environments where quick, reliable insights outperform scattered opinions or basic scores. It gives a cost-effective edge for building strong portfolios with less effort.

For those considering options such as Seeking Alpha for diverse ideas or TipRanks for expert metrics, MarketDash offers a smarter, AI-enhanced way to identify winning stocks and streamline investment strategies. It provides the perfect combination of resources, enabling faster, smarter decision-making.

Start your free trial today and see why thousands of investors trust MarketDash to simplify their stock research!

Related Reading

- Best Portfolio Analysis Software

- Stock Rover vs Seeking Alpha

- Finviz vs Tradingview

- Finviz Alternatives

- Seeking Alpha Alternatives

- Seeking Alpha vs Morningstar

- Seeking Alpha Alternatives

- Seeking Alpha vs Tipranks

- Motley Fool vs Morningstar

Try our Market Analysis App for Free Today | Trusted by 1,000+ Investors

Switching between Seeking Alpha and TipRanks can feel like trying to see everything, but this back-and-forth often breaks focus, leaving good ideas not fully developed.

Platforms like MarketDash help teams consolidate alerts and notes into a single, clear system. By running it for one week and applying it to every candidate, users can see, in terms of hours saved and improved position sizing, whether a consolidated, AI-assisted process actually accelerates decisions and boosts confidence.